Maintaining financial flexibility and balancing stable growth with total shareholder return (TSR)

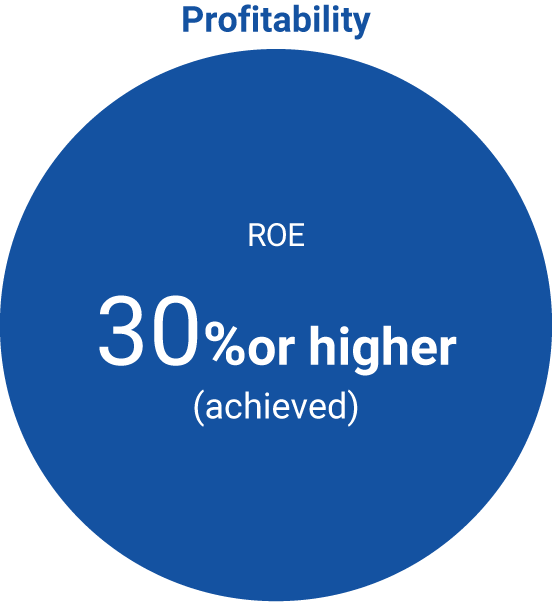

We maintain strong growth and aim for a mid-term sales growth rate of over 15%. High profitability and a high total asset turnover ratio result in a high ROE. Our business model is primarily based on fixed-price contracts based on man-month rates, and approximately 90% of sales are generated from existing clients. This allows us to secure stable cash flow, which will be appropriately allocated to shareholder returns and growth investments.

We plan to commence dividend payments in FY2025. Based on incremental dividends, the dividend payout ratio will be around 20-30%, ensuring that the dividend amount for the current period does not fall below the previous period, aiming to provide individual shareholders with the confidence to hold our stock long-term.

Based on organic growth of 15% or higher, we will pursue further growth by layering on additional value through M&A while maintaining financial soundness. Furthermore, by strengthening shareholder returns, we aim to enhance corporate value and maximize TSR.

Medium-term financial guidelines